owner draw quickbooks s-corp

An owners draw is an amount of money an owner takes out of a business usually by writing a check. This article describes considerations for C corporations the.

Question Can Owner Draw Be Greater Than Salary S Corp Seniorcare2share

Remote Learning Private Parties Art.

. Funding an S-corp with personal cash increases the business bank account and owners equity account by the same amount on your balance sheet. Select your city from the list to see classes in Boston. How to enter owner equity and balance the books properly after member draws are taken My business is taxed as an S-Corporation.

S corporations and C corporations cannot take draws. However before taking an owners draw you may be required to take a reasonable compensation as an employee. Dealership owners would like to reward themselves and their partners with attractive compensation when business is good.

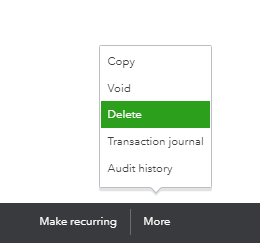

This is important to note since if your basis is reduced to zero your taxes get a bit more complicated. It does not have any impact on income. In QuickBooks Desktop software.

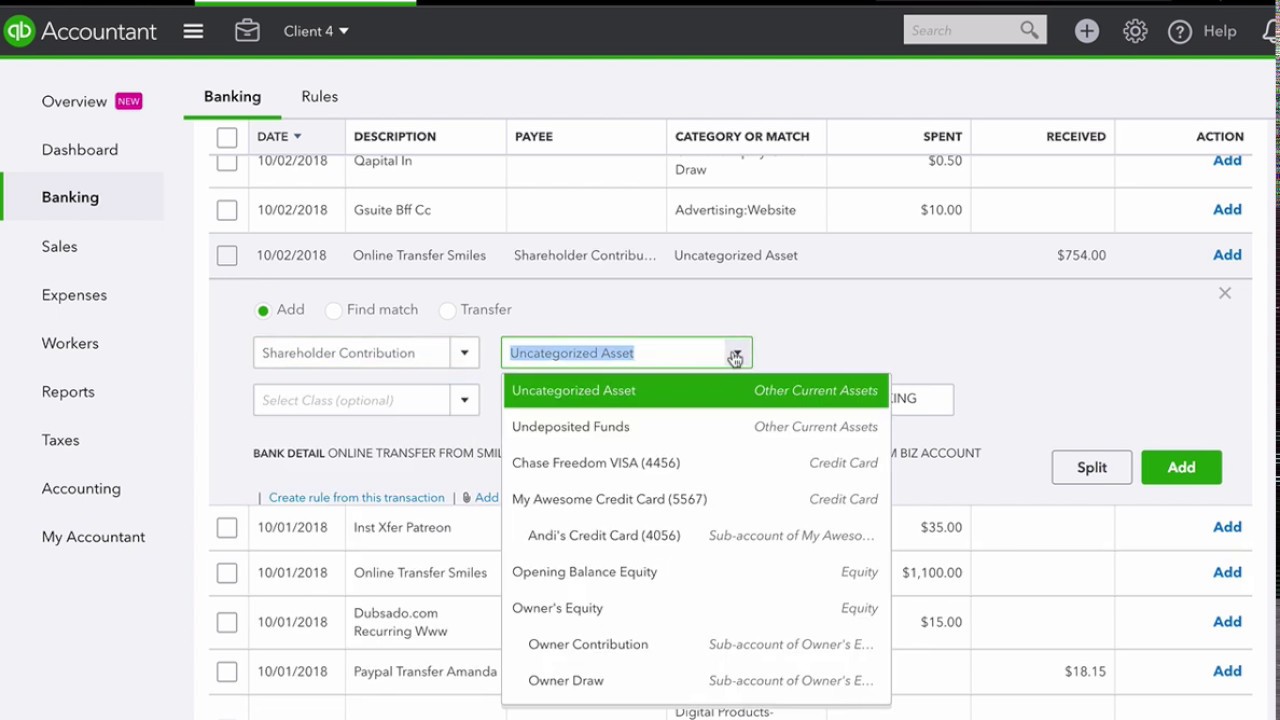

A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity. A draw lowers the owners equity in the business. When you put money in the business you also use an equity account.

There are no tax implications if this was funded by your after-tax income. The information contained in this article is not tax or legal. Gift Cards Wishlist 0 Give Get 15.

A owns 100 of the stock of S Corp an S corporation. Corporations should be using a liability account and not equity. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck.

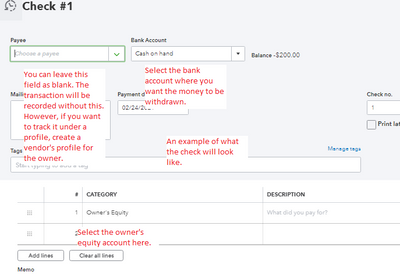

Owners draw in a C corp. Owner draw is an equity type account used when you take f Owner draw is an equity type account used when you take funds from the business. To Write A Check From An Owners Draw Account the steps are as follows.

Looking for classes in Boston. S-Corp Officer Compensation. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business.

But they must be careful. I know that using a Liability account isnt technically correct but the basic accounting equation can be sorted out easy enough Assets - Liabilities Owners Equity. Because of this most S-Corporation owners try to choose a low but reasonable salary.

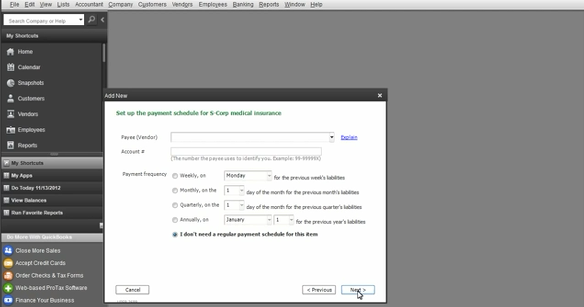

I would like to have accurate PL statements and be sure that all my transactions balance on reconciliation after entering member withdrawals. Click on the Banking menu option. Create a business Other Liability account.

Heres 10 towards your first class. Then choose the option Write Checks. Reduce your basis ownership interest in the company because they are equity transactions on your balance sheet.

In this section click on the Owner. Similarly what is owners draw vs owners equity in Quickbooks. A C corp dividend is taxable to the shareholder though and is not a tax deduction for the C corp.

The business owner takes funds out of the business for personal use. Owners equity is made up of different funds including money youve. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw.

An owner of a C corporation may not. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the. If A draws a 100000 salary Ss taxable income will be reduced to zero.

Business owners might use a draw for compensation versus paying themselves a salary. A is also Ss president and only employee. So your chart of accounts could look like this.

Recording owners draw in Quickbooks is a quick and easy process that should only take a couple of minutes assuming youve already set up the account using the steps previously mentioned. Now enter the amount followed by the symbol. However corporation owners can use salaries and dividend.

An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. S generates 100000 of taxable income in 2011 before considering As compensation. Due tofrom owner long term liability correctly.

An owners draw also called a draw is when a business owner takes funds out of their business for personal use. Make sure you use owners contributionsdraws equity vs. Example 1.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Owners draws are usually taken from your owners equity account. If you are a small business owner or running a proprietorship firm then it is essential for you to know how to record S-Corp distribution in QuickBooks easily.

Youre allowed to withdraw from your share of the businesss value. I named it Shareholder Draws to be consistent with what I had in QBs. Owners Contribution to S Corp.

In the Write Checks box click on the section Pay to the order of. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. Owners of some LLCs partnerships and sole proprietorships can take an owners draw.

Before we discuss those steps we hereby guide you about escort in detail. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. IRS guidelines on paying yourself from a corporation.

As a business owner at least a part of your business bank account belongs to you. The IRS is watching to make sure compensation levels are reasonable and it pays particular attention to the dealerships business structure. Instead shareholders can take both a salary and a dividend distribution.

In this article you will get to know all the easy steps for the recording of S-Corp distribution in QuickBooks. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. So if you have an S corp taking out less money as a salary and more as an owners draw can provide your business with extra federal payroll tax savings.

C corp owners typically do not take draws.

Solved S Corp Officer Compensation How To Enter Owner Eq

Distributions In Quickbooks Online Explained Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Benefits Of Owning An S Corp Taking Distributions

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

Solved S Corp Officer Compensation How To Enter Owner Eq

Best Online Invoice Billing Software Invoicing Software Create Invoice Online Invoicing

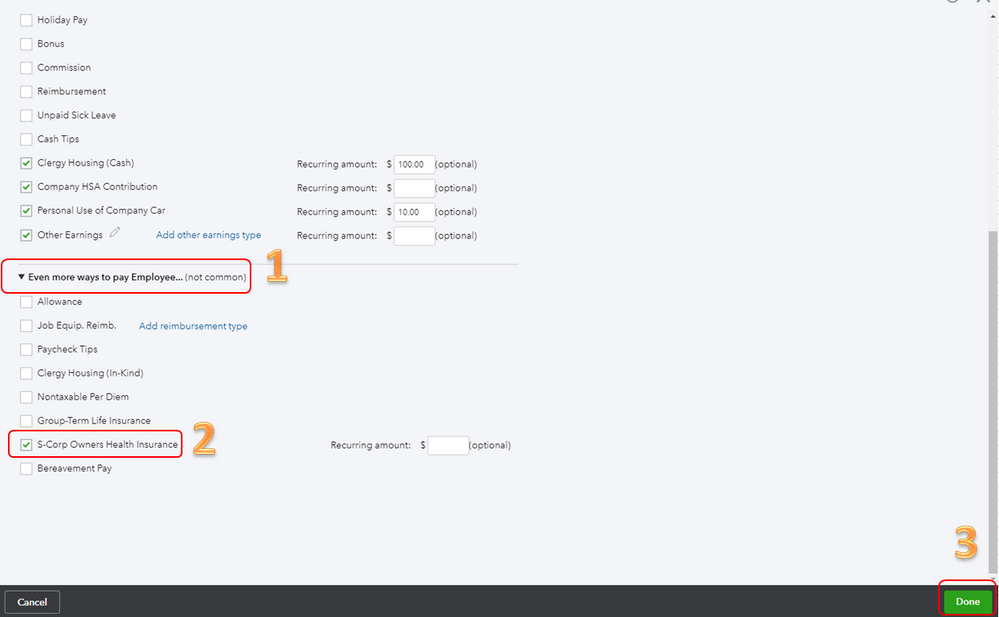

Solved How To Add S Corp Owner S Health And Life Insurance To Wages

Starting An S Corp Forbes Advisor

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Solved How To Add S Corp Owner S Health And Life Insurance To Wages

Solved S Corp Officer Compensation How To Enter Owner Eq

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Solved How To Add S Corp Owner S Health And Life Insurance To Wages

6 Essential Words To Understanding Your Business Finances Bookkeeping Business Small Business Bookkeeping Small Business Finance